According to the report of the United Nations Conference on Trade and Development (COUNTER) on world investment for 2021, the inflow of foreign direct investment to Cameroon, traditionally low compared to the potential of its economy, reached 488 million US dollars in 2020, which is a sharp decrease compared to 1027 million US dollars registered in 2019 year, due to the health crisis and the global economy caused by the Covid-19 pandemic. Reserves of foreign direct investment are estimated at $9 billion in 2020. According to the COUNTER Investment Trends Monitoring, global foreign direct investment flows increased sharply in 2021, but foreign direct investment flows to African countries (with the exception of South Africa) increased only slightly.

Most of the foreign direct investment comes from the European Union, especially from France and Germany, and is aimed at the mining industry, including oil production. However, China has become the largest investor in the country, implementing major infrastructure projects. As part of the growing interest in Africa, China regularly invests in Cameroon (according to the Ministry of Economy of Cameroon, the total volume of China’s direct and indirect investments in 2016 amounted to 2.43 billion US dollars), which allows the construction of the port and industrial complex of Kribi and the hydroelectric dam from Memwe’ele. The Africa Cup of Nations, held in early 2022, stimulated investment in tourism, real estate and infrastructure.

Cameroon’s economy has the potential to become one of the most prosperous countries and is among the countries most suitable for receiving foreign direct investment in Africa. While the country has numerous natural resources (oil, timber, fishing), as well as fertile land for construction, it must improve and simplify its governance in order to stimulate entrepreneurship and fight corruption.

| Foreign Direct Investment | 2019 | 2020 | 2021 |

|---|---|---|---|

| SIDE inflows (millions USD) | 1.027 | 675 | 850 |

| Stocks d’IDE (millions USD) | 8.538 | 8.931 | 9.781 |

| Number of greenfield investments | 23 | 11 | 8 |

| Value of new investments (million USD) | 1.188 | 206 | 191 |

Source: CNUCED – Latest available data.

Note: *Investments in greenfield correspond to the creation of ex-nihilo subsidiaries by the parent company

Why is it worth investing in Cameroon ?

Strengths

The main assets of the Cameroonian economy are:

- A long period of political stability under the existing regime

- Cheap labor

- Rich natural resources (agricultural, oil and mining)

- Economy diversified by exports (oil, mining, agriculture, etc.)

- Many current infrastructure modernization projects are being implemented, in particular, at the expense of IMF loans

- Stability of the currency due to its belonging to the CFA franc zone.

- Positive impact of anti-corruption policy

- The regulation on the share capital, which allows foreigners to own 100% of the company’s shares

Weaknesses

The main weaknesses of the country are:

- The tax pressure on the private sector is one of the highest in the world

- High risk of corruption

- Lack of infrastructure

- Cameroon has a trade deficit, depends on food imports and is therefore subject to external shocks.

Measures taken by the Government

The Government of Cameroon has identified some sectors as priorities for investment: transport, agro-industry, tourism and rural development. In order to further attract investors, the state authorities, with the support of sponsors, are implementing large-scale programs to improve justice, increase the supply of energy, improve economic information, simplify procedures, support enterprises, and ensure the protection of the economic space from illegal threats.

Cameroon also has free zones in which all export-oriented enterprises can be located, that is, producing goods and services intended exclusively for export. The advantages for the company are numerous: exemption from any licenses, permits or quota restrictions on exports and imports, the ability to open accounts in foreign currency, no restrictions on transactions for the sale, purchase of foreign currency, the right to transfer profits abroad (however, 25% must be reinvested in Cameroon), exemption from taxes and fees for 10 years from the beginning of the activity, taxation at a total rate of 15% of the profit from the 11th year.

Procedures concerning foreign investments

Freedom of institution

In Cameroon, access to the profession of a trader is free.

Regulation concerning equity

Foreigners can be 100% owners of the company.

Reporting obligations

The Agency for the Promotion of Foreign Investment in the country allows you to learn about the permits required for placement.

However, the applicant must meet, depending on the circumstances, the following conditions:

— Be registered either in the commercial register or in the municipal directory

— By making a statement of existence; — To have a professional card of the seller

— To have premises and material means when it is necessary;

— To perform other professional duties, especially in tax matters

— To obtain a preliminary permit (for persons with foreign citizenship).

The organization to which the investment declaration should be submitted

Government Portal

Request for specific permission

For more information, click Invest in a free zone.

Investment opportunities

For more information, click Invest in a free zone.

Investment Promotion Agency in Cameroon — CIPA

Investment Promotion Agency — Cameroon — IPA

Tenders, projects and public procurement

ARMP, public oversight body —

information about tenders in Cameroon, tenders in Cameroon

dgMarket, tenders around the world

Useful resources

The African First Bank (formerly the United Pension and Investment Fund),

the International Finance Corporation (IFC), the World Bank Group, financing projects in various sectors: agro-industrial complex, tourism.

Investment Promotion Agency — A.P.I

The Investment Promotion Agency (API) is a state administrative institution with legal personality and financial autonomy. The headquarters of A. P. I is located in Douala. A. P. I is under the technical guardianship of the Ministry of Private Investment Promotion and under the financial guardianship of the Ministry of Finance.

HIS MISSIONS

The mission of A. P. I, together with other relevant public and private administrations and organizations, is to contribute to the development and implementation of public policies in the field of investment promotion in Cameroon. In this capacity, A. P. I is responsible, in particular:

- For promoting the brand image of Cameroon abroad;

- Participate in improving the enabling and enabling environment for investment in Cameroon;

- Propose measures that can attract investors to Cameroon, as well as measures that can improve the implementation of industry codes;

- Create a database of projects available to investors;

SERVICES OFFERED

In addition, the IPA provides investors with the following public services:

- Reception, assistance and consulting of foreign and domestic investors at the stages of development of investment projects;

- Receipt and processing of application files for obtaining permission for one of the privileged regimes provided for by the Investment Charter, as well as for the regime of structural projects introduced by the general tax Code;

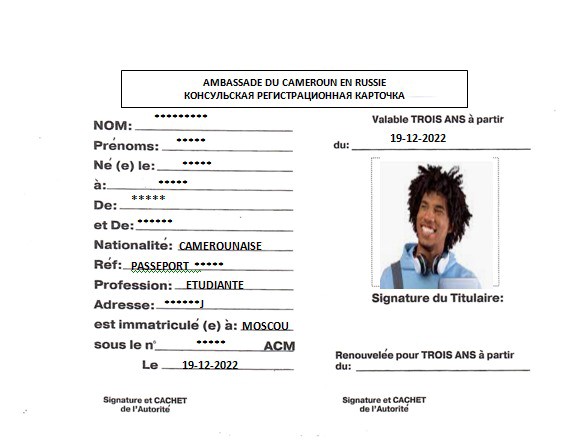

- Obtaining visas required for the implementation of investment programs of licensed companies and for the stay of their foreign personnel in Cameroon;

- Assistance to licensed companies in the procedures necessary for the implementation of their investment programs;

- Establishment of simplified administrative procedures by type of activity in cooperation with competent technical services;

- Monitoring and control of the fulfillment of obligations assumed by authorized companies.